Kicking off with How to plan for early retirement, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

Planning for early retirement involves understanding your finances, setting clear goals, creating a budget, maximizing savings, and developing multiple income streams. It’s all about securing your financial future and living life on your terms.

Understand Your Current Financial Situation

To begin planning for early retirement, it is crucial to have a clear understanding of your current financial situation. This involves analyzing various aspects like income, expenses, savings, investments, and debts.

Assessing Income, Expenses, Savings, Investments, and Debts

- Income: Calculate your monthly income from all sources, including salary, bonuses, rental income, etc.

- Expenses: Track your monthly expenses to determine where your money is going and identify areas where you can cut back.

- Savings: Evaluate your current savings and determine if you are consistently putting away enough money for retirement.

- Investments: Review your investment portfolio to ensure it aligns with your retirement goals and risk tolerance.

- Debts: Take stock of any outstanding debts and create a plan to pay them off to improve your financial health.

Key Financial Metrics to Consider

- Net Worth: Calculate your assets minus your liabilities to get a clear picture of your overall financial health.

- Savings Rate: Determine the percentage of your income that you are saving each month to gauge your progress towards retirement.

- Debt-to-Income Ratio: Assess how much of your income is going towards debt repayment to ensure it is at a manageable level.

Importance of Having an Emergency Fund

Having an emergency fund is crucial to protect yourself from unexpected financial setbacks. Aim to save at least three to six months’ worth of living expenses in a separate account that is easily accessible in case of emergencies. This fund can provide a safety net and prevent you from dipping into your retirement savings prematurely.

Set Clear Financial Goals: How To Plan For Early Retirement

Setting clear financial goals is crucial for planning early retirement. These goals need to be specific, measurable, achievable, relevant, and time-bound (SMART) to ensure success in achieving them.

Short-term Financial Goals

Short-term financial goals for early retirement planning may include:

- Building an emergency fund of three to six months’ worth of expenses.

- Maximizing contributions to retirement accounts like 401(k) or IRA.

- Reducing high-interest debt like credit card balances.

Long-term Financial Goals

Long-term financial goals for early retirement planning may include:

- Accumulating a retirement savings goal of a specific amount by a certain age.

- Paying off the mortgage on your home before retirement.

- Investing in additional sources of income like rental properties or stocks.

Prioritizing Financial Goals, How to plan for early retirement

It’s important to prioritize financial goals based on individual circumstances and timelines. Factors like age, income level, debt obligations, and retirement timeline will influence which goals should take precedence. By assessing your current financial situation and future needs, you can determine the most critical goals to focus on first.

Create a Realistic Retirement Budget

Creating a comprehensive retirement budget is essential for ensuring financial stability during your retirement years. It involves careful planning and consideration of various factors to accurately estimate your future expenses and adjust your budget as needed.

Estimating Future Expenses

- Start by listing all your current expenses and categorizing them into essential (such as housing, food, and healthcare) and non-essential (like travel and entertainment).

- Consider potential changes in expenses, such as healthcare costs increasing as you age or mortgage payments being paid off.

- Account for inflation and adjust your budget accordingly to ensure your income covers rising costs over time.

- Factor in one-time expenses, such as home repairs or a new car, that may arise during retirement.

Adjusting the Retirement Budget

- Regularly review your budget and make adjustments based on changes in your lifestyle, health, or financial situation.

- Be prepared to cut back on discretionary spending if needed to stay within your budget and maintain financial stability.

- Consider unexpected expenses and create an emergency fund to cover any unforeseen costs that may arise.

- Consult with a financial advisor to get professional guidance on managing your retirement budget and making informed decisions.

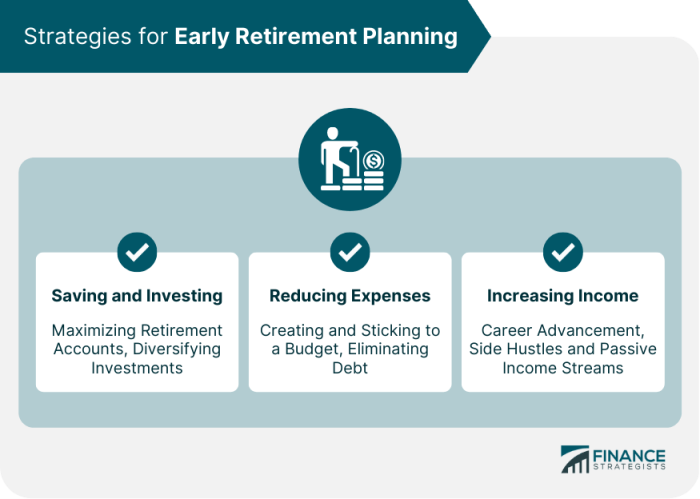

Maximize Retirement Savings

When it comes to maximizing your retirement savings, there are several strategies you can implement to secure a comfortable financial future. By taking advantage of retirement accounts like 401(k), IRA, or pension plans, you can set yourself up for success in your golden years.

Diversify Investments

Diversifying your investments is key to mitigating risks and optimizing returns. By spreading your money across different asset classes such as stocks, bonds, and real estate, you can protect your savings from market fluctuations and potentially earn higher returns over time.

- Invest in a mix of stocks and bonds to balance risk and reward.

- Consider adding real estate or alternative investments to your portfolio for diversification.

- Regularly review and adjust your investment strategy to align with your risk tolerance and financial goals.

Compound Interest

Compound interest is the concept of earning interest on both the initial principal and the accumulated interest. This means that your savings can grow exponentially over time, especially when invested in long-term vehicles like retirement accounts.

- Start investing early to take advantage of the power of compound interest.

- Reinvest your earnings to accelerate the growth of your retirement savings.

- Choose investments with compounding features to maximize your long-term returns.

Develop Multiple Income Streams

Developing multiple income streams is crucial for financial stability, especially in retirement. By exploring various ways to generate passive income, you can ensure a steady flow of money even after you stop working. Diversifying your income sources can provide added security and flexibility in managing your finances.

Advantages of Multiple Income Streams

Having diverse income sources offers several advantages. It reduces the risk of relying solely on one source of income, making you less vulnerable to financial downturns. Additionally, multiple streams of income can help you achieve your financial goals faster and provide a safety net in case one source dries up.

- Diversification reduces financial risk

- Accelerates progress towards financial goals

- Provides a safety net in case of income loss

Side Hustles and Investment Opportunities

Exploring side hustles or investment opportunities can be a great way to add extra income. Consider starting a small business, freelancing in your area of expertise, or investing in real estate or stocks. These ventures can supplement your primary income and contribute to building wealth for your retirement.

Remember to research and assess the risks involved in each income-generating opportunity before diving in.